Website Review- BankBazaar.com

I wrote a piece on The Story and Strategy of Money Portals in India (http://atomthought.com/?p=5), a few months back. The idea was to decipher what the Indian consumers want from a money portal and how can that portal satisfy their needs of information and application without much intrusion.

I wrote a piece on The Story and Strategy of Money Portals in India (http://atomthought.com/?p=5), a few months back. The idea was to decipher what the Indian consumers want from a money portal and how can that portal satisfy their needs of information and application without much intrusion.

Last year we saw a multitude of portals that were launched just to generate leads-they had nothing to do with user experience or user needs! But as recession hit us and as time passed, we are now also witnessing smart new players in the market who use a combination of technology and functional knowledge to create beautiful user experience and offer relevant products with the vision of closing a deal end to end!

I decided to come back on this topic and review a few of these portals over a period of time, and the first one that I decided to review was a portal called Bankbazaar.com. Since this is not a business model review I have tried restricting myself to the website only, except for a few occasions.

My review is based on a mix of the following attributes:

The Product Breadth and Depth

Product Types and Variants

Alliances

User Experience

Process of application

Presentation of information and overall design

Tools to help decide better and faster (comparison, calculators)

End-to end carriage of information

I think the home page of bankbazaar is easily among the best – in terms of delineation of core USP, easy to locate information, and being very focused.

The home page actually announces in your face, the exact time when one one can get multiple personalised quote. This is a powerful proposition and is announced very aptly, it actually propels you to just move for further action.

Could we make it more impactful and can we reduce one step here?

bankbazaar could also announce that they have the ‘Best Rates in the Market’ (conditions apply)

Also, there is merit in considering presenting the loan calculator on the first page. Prospects can choose the product type and fill in important details to start off the process right from the home page.

Now, as far as product variety is concerned, bankbazaar is still not there yet! They just have Home Loans and Personal Loans (apart from Credit Cards which is still in Beta). In today’s market scenario-I am not sure these 2 or 3 products alone cannot give them the volumes or can help them create enough traction with banks and consumers.

We all know that this is a volumes game, and one of the reasons why we have a wide product line is to attract a wider target audience and play on volumes eventually.

Anyway, as far as the product depth is concerned, I think bankbazaar has a fairly good depth in terms of product variants as also in terms of addressing variants of target audience. So, they have personal loans for salaried, self employed professionals and non-professionals etc.

But just to compare this with SBI, at last count I found that they have over 130 products catering to almost every section of society and every purpose.

bankbazaar should actually make a matrix of products and needs and see which products they should launch. This will help in creating rich content, assure prospect involvement and also help them in managing customer lifecycle (on loan buyer, tomorrow can be an insurance buyer, and the same buyer can be pitched a credit card etc.)

bankbazaar has alliances with 8 banks, including the likes of HDFC and Axis, and that’s a very good number, considering that a consumer really may see little incremental value in looking beyond 4-5 options unless it’s a credit card or an insurance. There is also value in adding public sector banks. This adds credibility to the site.

User Experience: I am impressed with the process, the way the form has been designed and the data input mechanism with auto tabbing and sliders.

The form is designed in such a way that prospects who do not meet the minimum criteria (apart from income) are filtered in stage1 itself.

In stage 2 one receives a comprehensive list of options and quotes, which can be compared and applied to easily.

I was impressed with the intelligent use of Sliders here. Sliders are not new, and nowadays you can find them on various travel sites and a few good financial sites as well. But Sliders have a limitation on the maximum value. Bankbazaar sliders have overcome this limitation, and do not seem to have a set any particular maximum value, their maximum value changes depending upon the limit ascribed to a particular prospect.

At times however it becomes difficult to operate sliders, especially if you move from, say, 5.9 to 6.0.

To handle that bankbazaar may consider supplementing this with text input option

Mouse hover on an option presents all information neatly in a small box. One can also email the offers to self or others.

Once compared and analyzed, one has to click on View Details and review and then move to Stage 3 for final application. I think this could have been managed on one page and the prospect could be saved one extra click here.

One also has an option of saving and exiting without completing the entire process. If one is already logged in- the forms automatically auto-saves and one can return back and start from wherever one left. If not logged in, in stage 3 there is a simple 2 field registration without disturbing the process flow.

Use of Calculators: Allowing the calculators to be downloaded and shared via ‘Tell a friend’ application is a very wise move.

Also the calculators are not at all intimidating- the figures are presented graphically and again there is an intelligent use of sliders/ajax for real time information change and presentation.

Bankbazaar should include more calculators as they continue to add newer products.

As far as the customer care part is concerned, there’s a live chat option, which may not work 24*7 and on holidays. Given that internet access in India is largely from offices and in weekdays, its fine as of now to have this facility as it is, but one may consider upgrading this soon.

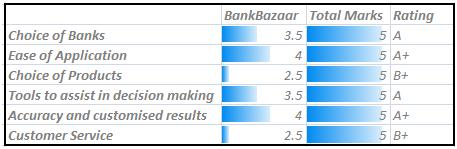

Time for scores

I think overall, the

1. Intelligent use of sliders

2. Auto tabbing and mouse hovers

3. Presentation of rates and amounts basis type of organisation one works in (and may be basis another couple of parameters)

4. Presentation of about 4-5 options, with details

5. Auto saving of the process and

6. Quick registration

Make Bankbazaar easily one of the most user friendly sites in the industry.

My recommendation to Bankbazaar would be to:

1. Ramp up fast– It’s a volumes game, get more visitors.

2. Give more choice– of banks and products, no matter if it’s a seasonal and low margin thing like Gold Coins.

3. Invest in CRM– Intelligent use of call centre coupled with a CRM can help you service better and reap more revenues through their life cycle management.

4. Mobile Integration: through widgets and wap.

5. Live Bank Integration– for online instant approval, rating & scores etc. As also alerting end users on live updates of their application.

Disclaimer: I have been approached by Bankbazaar to write an unbiased review of their site. This review has not been shared before being published on AtomThought.com, and all care has been taken to make it unbiased and valuable for the readers of this blog.